In 2024, Likwid and Gescobro—leaders in financial services and debt management—decided to fully digitize their operations. They needed a robust, scalable, and secure solution to improve customer relationships and optimize collection processes.

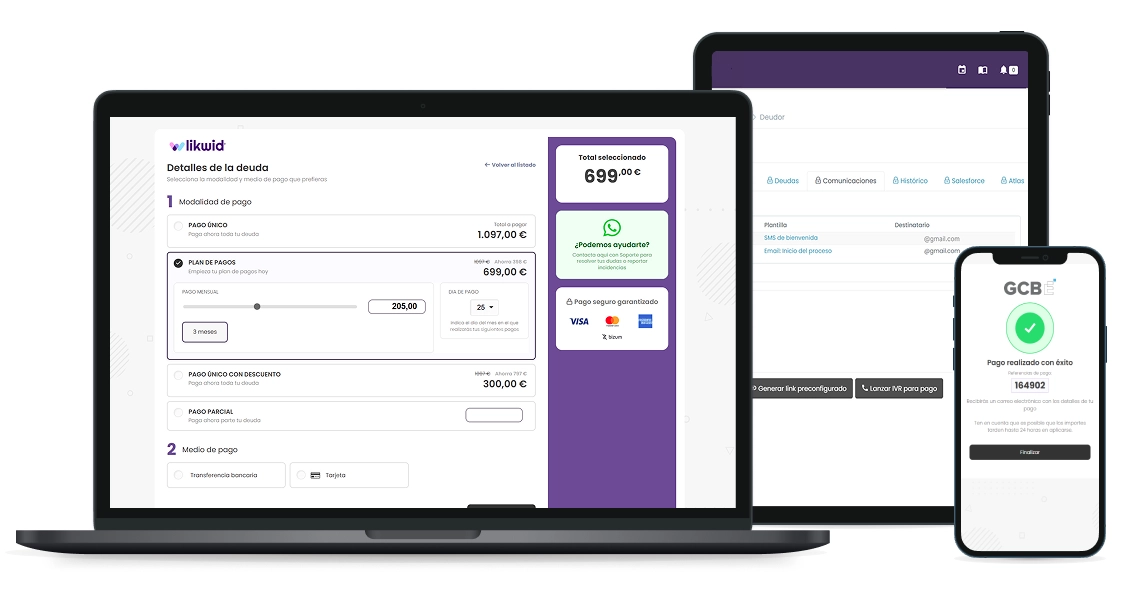

In response to this challenge, Ganbaru Smartech designed and developed a fully customized, comprehensive, and configurable payments platform. It integrates with both companies’ internal systems (Salesforce for Likwid and Atlas for Gescobro) and offers a powerful management backoffice as well as an intuitive, multichannel payment site for debtors. All of this is supported by a robust architecture deployed on scalable cloud infrastructure in AWS.

We created a centralized administration panel that allows the management of users, portfolios, debtors, promotions, forms, automations, and statistics from a single interface. This system supports granular roles and permissions for detailed access control, real-time data synchronization with Salesforce and Atlas, full debtor profiles with payment and communication histories, and campaign launches via email, SMS, or IVR with personalized payment links.

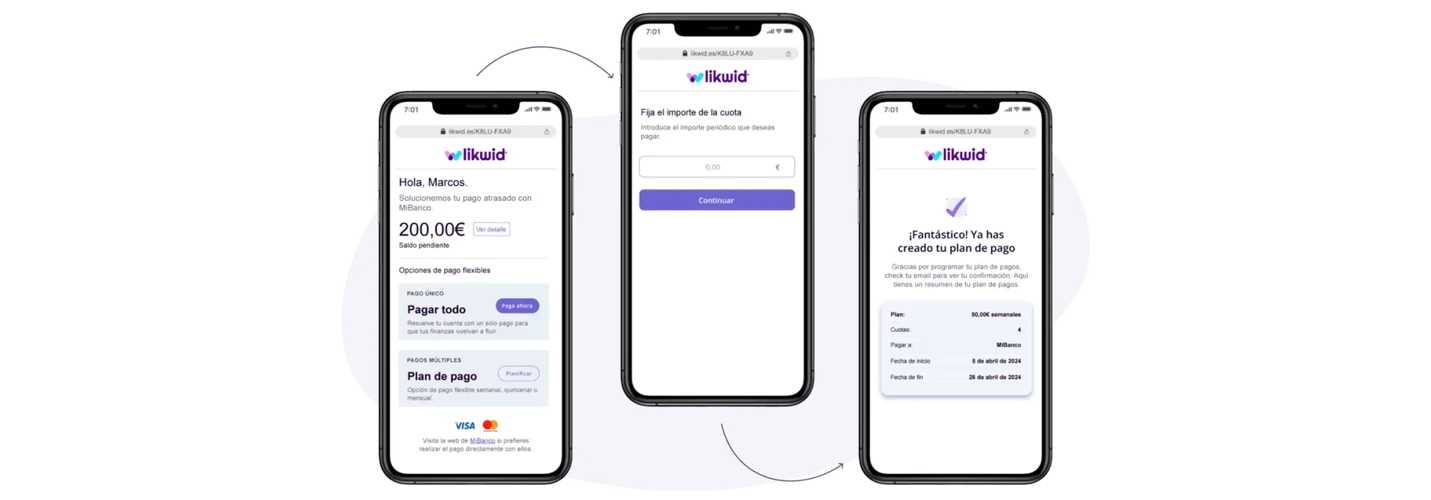

We designed a responsive, accessible payment site focused on usability and conversion. Users can access it through unique or pre-configured links, choose between one-time or installment payments, select their preferred payment method (card, Bizum, IVR, Sofort, among others), and complete transactions easily and quickly, enjoying a frictionless experience across any device.

We integrated the platform with Redsys, PayNoPain, and PayByCall to ensure secure, agile payments without storing sensitive data. This enables recurring payments without user intervention and allows the configuration of specific terminals and merchant codes by portfolio or project, enhancing traceability and optimizing fees.

Through the backoffice, automatic discounts or bonuses can be applied based on specific conditions such as debt amount, payment method used, or portfolio type. These rules execute automatically during the collection process, enabling dynamic campaigns that increase conversion rates without altering the original debt amount.

We enabled a visual automation engine that executes actions based on events or conditions. This includes sending notifications, updating statuses, generating tasks, or synchronizing data. This logic significantly reduces operational workload and enhances team efficiency.

The platform allows for the generation of custom reports, dynamic dashboards, and in-depth data analysis on payments, forms, campaigns, users, and more. Reports can be scheduled for automatic delivery or saved as reusable templates, facilitating data-driven decision-making.

We deployed the solution on a modern cloud architecture using Docker orchestrated with AWS ECS, enabling auto-scaling on demand. We used MySQL 8 with JSON document support, caching layers, and CDN to optimize load times, along with automated deployments via Git. Bastion servers were added to control internal environment access, and the entire infrastructure aligns with best security practices.

The project followed our standard methodology:

At Ganbaru Smartech, we specialize in designing and building custom technology solutions, fully integrable with your systems and focused on user experience, security, and scalability.

We help you transform your payments and debt recovery operations. Contact us for a free consultation and discover how we can help!