At Ganbaru, we partnered with Intrum, a European leader in credit management and financial services, to tackle a major challenge: fully digitizing their payment and banking reconciliation system. The goal was clear — to create a modern, secure, and scalable technology solution capable of adapting to the operational complexity of an organization that manages millions of transactions.

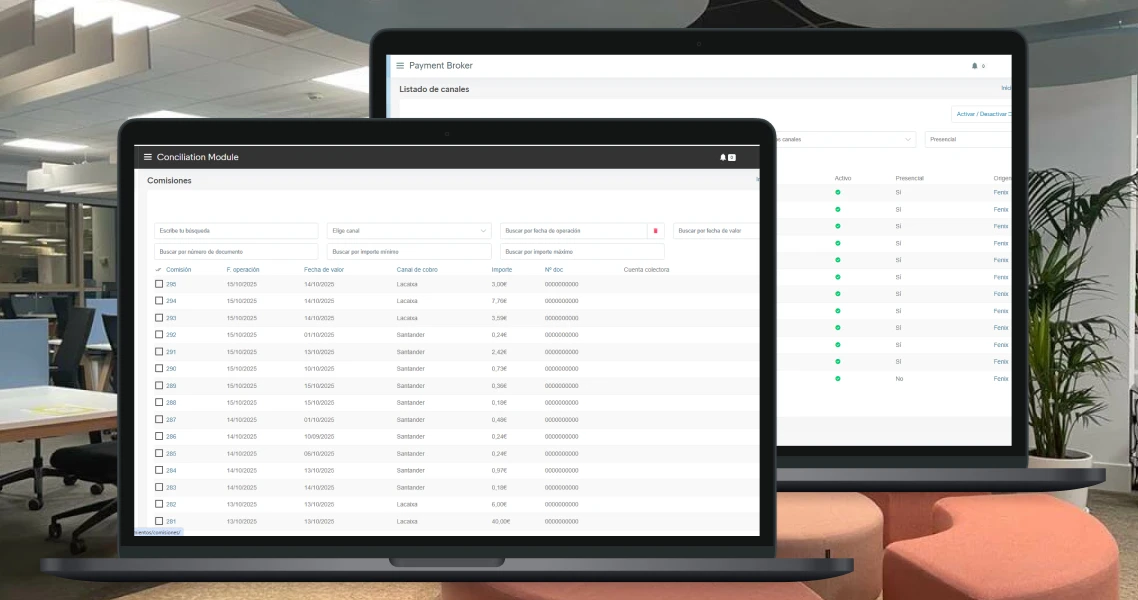

The result was the development of two fully integrated platforms — Payment Broker and the Conciliation Module — which now form part of Intrum's operational core. These tools have not only optimized the control and traceability of financial operations but have also enabled the automation of critical processes, reduced management time, and improved accounting transparency across the organization.

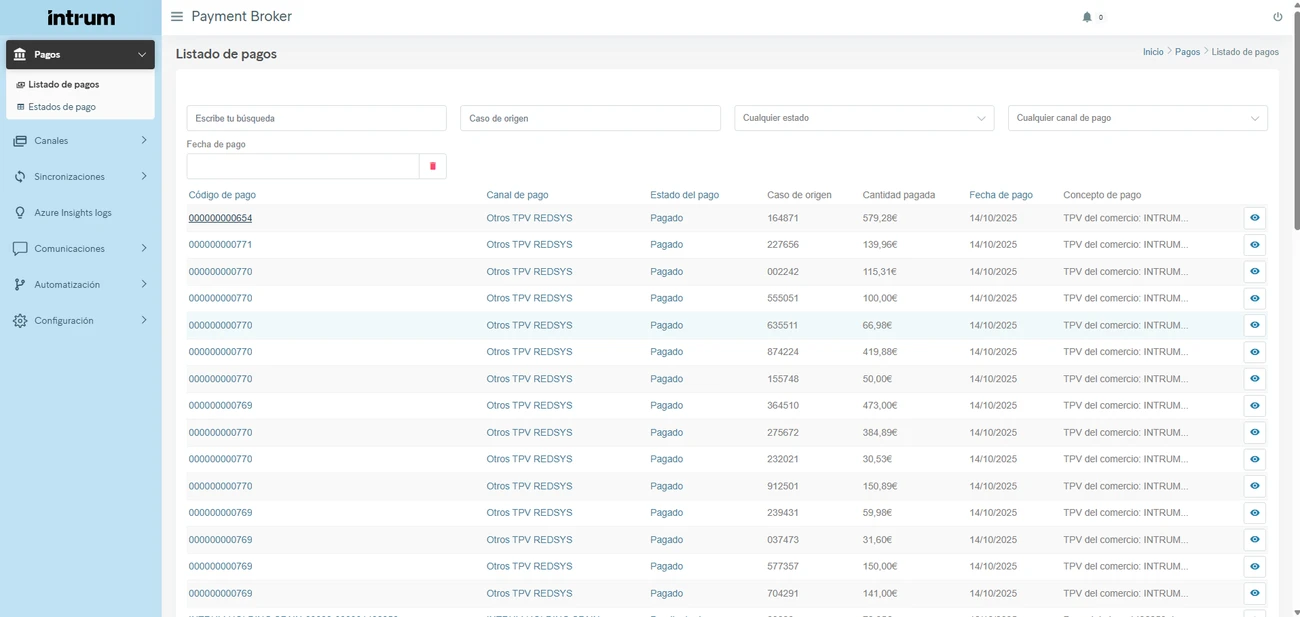

Payment Broker is a custom-built platform designed to manage the issuance, control, and traceability of payments across various channels, both in-person and remote. This system acts as a unified payment hub, capable of integrating with corporate portals, backoffice systems, debt management tools, and multiple external gateways such as Redsys, CECA, SEPA, Paygold, and Kineox.

Designed for maximum reliability and security, the broker handles complex payment statuses (pending, paid, canceled, refunded, etc.) with complete transaction traceability. Every operation is fully recorded, enabling precise internal audits and more informed decision-making.

Additionally, the platform includes a web-based backoffice with role-based access control, allowing administrative teams to monitor operations, check statuses, and perform manual tasks when necessary. This backoffice features a lightweight and accessible interface that can be used even without technical expertise.

The platform integrates with Intrum’s systems via a RESTful API and includes a reliable authentication and permissions model. This is achieved through OAuth2-based security, with corporate authentication handled by Olimpo, Intrum's identity management system. Secrets and credentials are securely managed through Azure Key Vault, and all communications are encrypted via HTTPS.

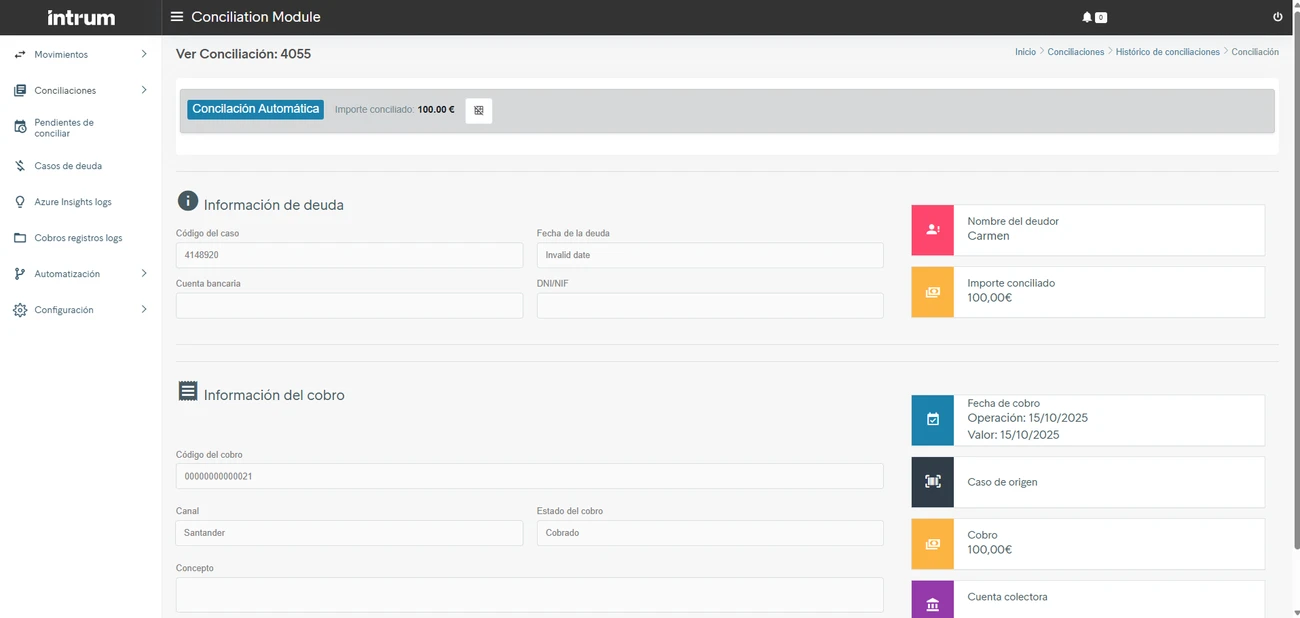

In parallel with the payment broker, we designed and developed the Conciliation Module, a strategic tool that automates the reconciliation of payments issued through the Payment Broker with incoming banking transactions.

The module automatically receives and processes banking files in Norma 43, Norma 57, and POS extracts (Redsys, CECA, Sabadell), delivered via secure channels such as SFTP. These transactions are reconciled against system-registered payments using a matching algorithm that cross-references case ID, exact amount, debtor identity, and other custom rules.

In cases where automatic matching is not possible, the system allows for manual reconciliation via a dedicated backoffice, equipped with advanced filters, traceability, and secure editing. The entire process is fully documented, and automatic reports are generated for integration with Intrum’s debt management system (Fénix) and corporate Datalake.

This solution has significantly reduced accounting reconciliation time, eliminated human errors, and improved financial transparency. It also helps to quickly identify and respond to returned or unrecognized payments.

Both the Payment Broker and the Conciliation Module are built on a cutting-edge cloud infrastructure, designed to deliver high standards of security, stability, and scalability.

The platforms are hosted on Microsoft Azure, an enterprise-grade cloud environment that ensures system availability even during usage peaks. Thanks to this architecture, services can scale automatically based on demand, with no downtime or performance loss.

All data — from payments to reconciliations — is stored in a modern, optimized database that enables efficient processing of complex structures. Banking files and attachments are stored in a secure cloud system that ensures nothing is lost and that only authorized users can access them.

To monitor the health of the system, we use advanced monitoring tools that provide real-time alerts if any issues arise. This allows us to respond quickly and minimize any potential impact.

Lastly, all development and system updates are handled through an automated deployment pipeline, ensuring higher quality, fewer errors, and faster delivery. This enables us to roll out new features, bug fixes, or updates in an agile and controlled manner.

The project was executed in iterative phases using agile methodology, with regular functional deliveries, ongoing validations, and gradual environment rollouts. Within less than two months, we delivered the staging environment with all key features, and shortly after, the system went live with auto-scaling and high availability.

Today, we maintain a dedicated weekly support and evolution plan, which includes everything from post-warranty bug resolution to the implementation of new features, generation of custom reports, and updates required by regulatory changes. This service is managed by a multidisciplinary team covering development, functional analysis, and operations.

We have also defined clear SLAs and an incident management protocol, with different response times based on issue severity (P1 to P3), and dedicated communication channels for urgent cases. This ensures service continuity and smooth communication with Intrum’s technical and business teams.

Intrum’s payment and reconciliation system transformation is a real-world example of successful digital transformation in the financial sector. Through a fully customized approach, we built a solution tailored to the company's internal workflows — one that scales with the business and can seamlessly evolve with future needs.

Thanks to these platforms, Intrum has not only enhanced its operational efficiency, but also strengthened its financial control, improved its incident response, and reinforced its position as an innovative player in the credit management market.